LMFP Batteries: Cost-Effective and High-Energy Density Solutions

Lithium manganese iron phosphate(LMFP batteries)

Lithium ferromanganese phosphate (LMFP) in the industry is considered to be an upgraded version of lithium iron phosphate (LFP), is the current feasibility of the relatively high lithium iron phosphate upgrade program. By manganese doping of lithium iron phosphate material, the synthesis of lithium iron phosphate solid solution material can effectively improve the energy density of lithium iron phosphate, and make LMFP batteries become an excellent energy storage material with high energy density and high safety.

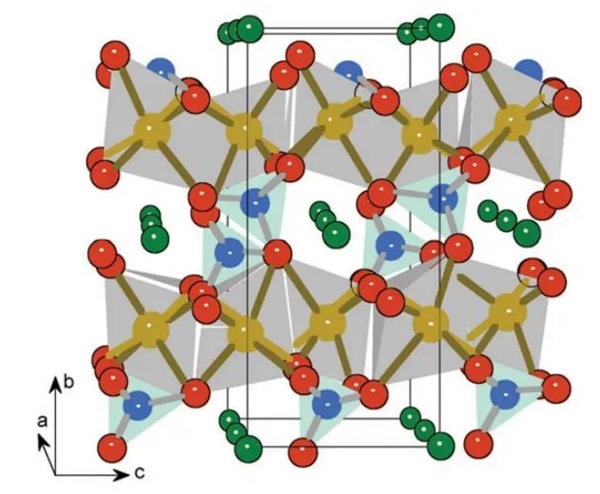

LMFP batteries belong to the olivine type structure, in which the PO4 (phosphate ion) tetrahedron is very stable, and can play a role in the charge and discharge process, so lithium ferromanganese phosphate has excellent thermodynamic and kinetic stability. However, its electronic and ionic conductivity is low, and the performance gap between it and the commercial ternary cathode materials is large. In recent years, researchers have done a lot of research work on the performance improvement of lithium ferromanganese phosphate cathode materials. At present, the main improvement methods include carbon coating, ion doping, nanocrystalline, etc.

Carbon coating

Due to the low electronic conductivity of LMFP material, if the conductive material is uniformly coated on the particle surface, the conductive resistance can be reduced to a certain extent, and the electrochemical performance of the material can be improved. Carbon material is the first choice of coating materials, carbon coating to improve the performance of the material mainly reflected in the following aspects: first, it can effectively prevent the growth of crystal particles; Second, it can prevent agglomeration between particles; third is to improve the electronic conductivity of the material and provide an effective lithium ion diffusion channel; Fourth, it is used as a reducing agent to prevent the oxidation of the material.

Ion doping

Ion doping can produce vacancy or change the interatomic bond length in the lattice of lithium ferradenophosphate material, facilitate the movement of lithium ions in the lattice, and effectively improve the conductivity of the material itself.

Navigation

When the particle size of the material is nanometer, the lithium-ion migration path can be shortened, and the larger specific surface area provides more interface area for the material to full contact with the electrolyte, thus obtaining excellent electrochemical performance.

Application Scenario

In the field of automotive power batteries

LMFP batteries pure composite has advantages and broad prospects. With the acceleration of the global electric vehicle process, the production of electric vehicle batteries continues to hit new highs, and the global sales of power four-wheelers in 2021 was 6.5 million units, an increase of 100% year-on-year. In March 2022, BYD officially announced the cessation of vehicle production of fuel vehicles, which also means that fuel vehicles are entering a decline stage in the domestic market, and there will be more vehicle companies to follow BYD, slowly withdrawing from the fuel vehicle market, transforming to focus on the production of new energy vehicles, and accelerating the global electrification process.

In the field of two-wheeled electric vehicles

The cost-effective LMFP batteries market share is rapidly advancing. LMFP+LMO (lithium manganese iron phosphate + lithium manganese acid) is considered to be one of the most cost-effective lithium battery systems in the field of two-wheel electric vehicles and has entered the stage of industrial production in China. In terms of mass production schedule, Tianjin Stran and Litai Lithium Energy announced the realization of mass production, and German nano planning capacity reached 440,000 tons, of which 110,000 tons is expected to be put into production in early 2023. In addition, Tianneng Shares has launched the corresponding super energy ferromanganese lithium battery application in the calf electric two-wheeled vehicle; Changzhou Lithium Source and Star Constant power supply also reached strategic cooperation on LMFP.

In the field of energy storage

Lithium iron manganese phosphate has more energy density advantages than lithium iron phosphate. According to the "New Energy Storage Guidance" formulated by the government, the size of China's new energy storage market based on lithium-ion batteries should increase from 3.3GW in 2020 to 30GW in 2025, an increase of about 8 times in 5 years, and a compound annual growth rate of more than 55%. According to relevant data, it is estimated that the global demand for energy storage batteries will be 500GWh by 2025, and as an important technical reform direction for LFP, it is predicted that in the field of energy storage, the replacement rate of LMFP for LFP will be 10% by 2025, and the demand will reach 45GWh.

Development trend

The cathode material is the most critical raw material for lithium-ion batteries. Upstream for all kinds of raw materials and auxiliary materials. The middle reaches are different types of lithium cathode materials, including ternary materials, lithium iron phosphate, lithium cobaltate, and lithium manganate. Downstream applications for power lithium batteries, consumer lithium batteries, and energy storage lithium batteries.

Upstream: the supply of metal raw materials is tight and the price is rising, and the mixed-use of lithium iron manganese phosphate is the key to cost reduction. Upstream metal raw material resources such as cobalt and nickel are scarce and expensive, but the upstream manganese ore resources of lithium iron manganese phosphate are rich, and lithium iron manganese has cost advantages. The global manganese ore is mainly used in iron and steel metallurgy, of which more than 95% is used in iron and steel metallurgy industry, the battery industry consumption accounts for about 2%, of which the amount of manganese used in lithium-ion batteries accounts for about 0.5%, and the increase of battery manganese has a small disturbance to manganese supply and demand.

Midstream: The positive electrode material market has a large growth space and rapid expansion of production capacity. Due to the sharp rise in the price of upstream lithium, cobalt, nickel, and other metals, the price of positive electrode materials has also risen significantly, and the entire positive electrode material industry has shown a "price and volume rise" prosperity in 2021 and has continued to this day. It is estimated that by 2025, China's positive electrode material shipments will reach 4.71 million tons, and the market growth space will be large.

Downstream: End demand drives technological progress. The end customer's demand for new energy vehicles in terms of price and performance drives the improvement of cathode material technology. With the rising demand for new energy vehicles and the decline of the government's subsidy policy for new energy vehicles, it is urgent to reduce costs and improve performance. Therefore, new technologies to improve battery performance on the basis of cost reduction usher in development opportunities, and lithium ferromanganese phosphate is the product of the development of new technologies.